Akobo Minerals announces minor adjustment to convertible loan amount

Published: 2024-11-13UTC15:34:18

OSLO, 13 November 2024: With reference to the press release issued on 05 November 2024 regarding the issuance of a NOK 25.3 million unsecured convertible loan, Akobo Minerals AB (publ) (Euronext and Frankfurt: AKOBO) (the "Company") announces a minor adjustment to the total loan amount where an additional NOK 200,000 has been added to the loan. As a result, the total convertible loan now stands at NOK 25.5 million. The terms and conditions of the loan, including interest rate, conversion options, and maturity, remain unchanged as previously communicated.

For further information, please refer to the original press release dated 05 November 2024.

DISCLOSURE REGULATION

This information is subject to the disclosure requirements pursuant to section 5-12 of the Norwegian Securities Trading Act. This information is considered to be inside information pursuant to the EU Market Abuse Regulation and was published by Jørgen Evjen, CEO, on the date and time provided herein.

For more information, contact

Jørgen Evjen, CEO Akobo Minerals

Mob: +47 92 80 40 14

Mail: jorgen@akobominerals.com

LinkedIn: www.linkedin.com/company/akobominerals

www.akobominerals.com

About Akobo Minerals

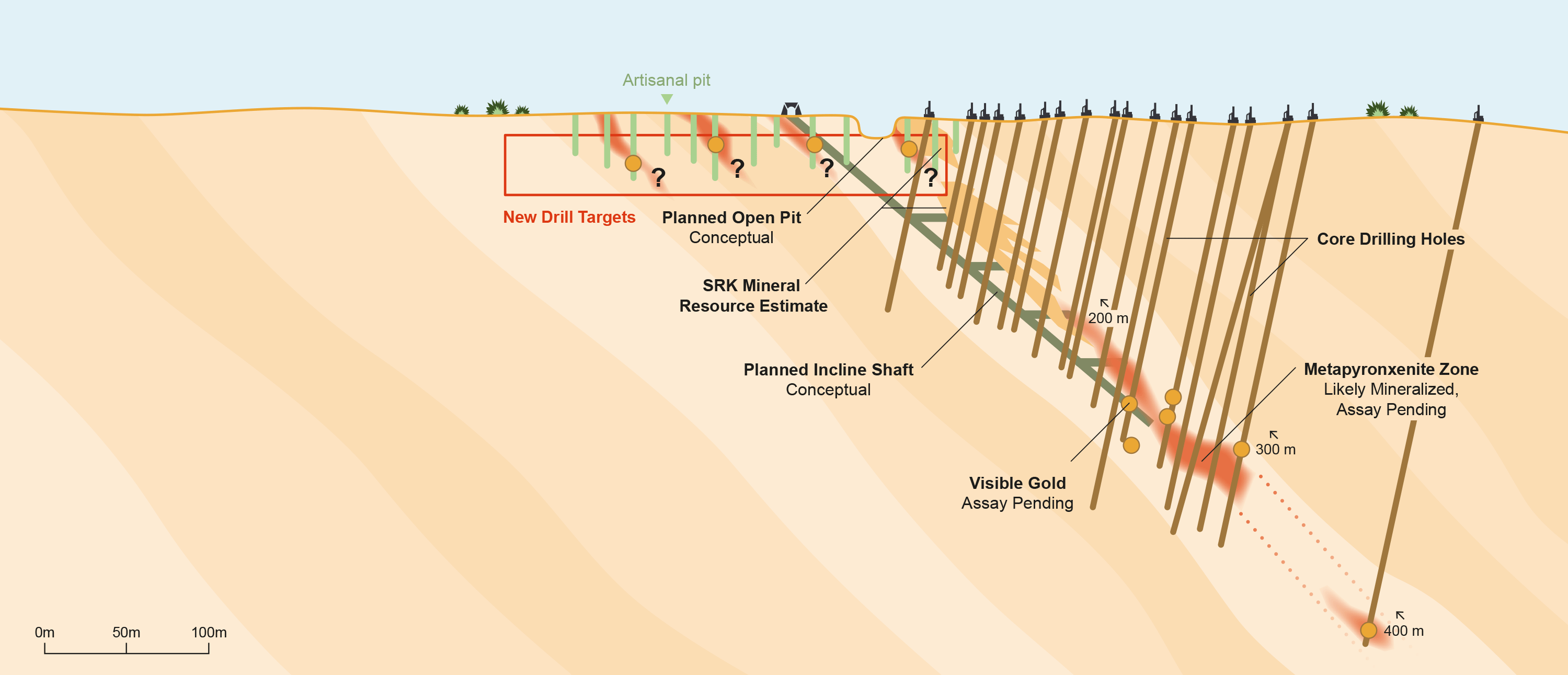

Akobo Minerals is a Scandinavian-based gold exploration and mining company, currently holding an exploration license covering 182 km2 and a mining license covering 16 km2 in the Gambela region and Dima Woreda, Ethiopia. With over 14 years of active operations on the ground, the company has established a strong foothold in Ethiopian gold exploration, now further strengthened with the startup of its Segele mine.

Akobo Minerals’ Segele mine has an Inferred and Indicated Mineral Resource of 68,000 ounces, yielding a world-class gold grade of 22.7 g/ton The mineralized zone remains open at depth, supporting future resource estimates and extending the mine’s life. The exploration license holds numerous promising exploration resource-building prospects in both the vicinity of Segele and in the wider license area.

Akobo Minerals maintains strong relationships with local communities and government authorities, placing ESG principles at the core of its operations. The company’s commitment to sound ethics, transparency, and stakeholder engagement is evident through its industry-leading extended shared value program.

Akobo Minerals is ready to take on new opportunities and ventures as they arise. The company is uniquely positioned to become a major player in the future development of the very promising Ethiopian mining industry.

The company is headquartered in Oslo and is publicly listed on the Euronext Growth Oslo Exchange and the Frankfurt Stock Exchange under the ticker symbol AKOBO. For US investors, Akobo Minerals AB (OTCQX: AKOBF) is traded on the OTCQX Best Market, adhering to high financial standards, best practice corporate governance, and compliance with U.S. securities laws. Additionally, the company has a professional third-party sponsor introduction, and investors can access current financial disclosures and Real-Time Level 2 quotes for the company on www.otcmarkets.com.

Akobo Minerals places great emphasis on meeting and exceeding industry standards, fully complying with all aspects of the JORC code, 2012. For detailed information on their adherence to this code, please refer to https://www.jorc.org/. Akobo Minerals' unwavering commitment to ethical practices, community engagement, and environmental responsibility positions them as a formidable force in the evolving landscape of the Ethiopian mining sector.

Important information This release is not for publication or distribution, directly or indirectly, in or into Australia, Canada, Japan, the United States or any other jurisdictions where it would be illegal. It is issued for information purposes only and does not constitute or form part of any offer or solicitation to purchase or subscribe for securities, in the United States or in any other jurisdiction. The securities referred to herein have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act"), and may not be offered or sold in the United States absent registration or pursuant to an exemption from registration under the U.S. Securities Act. Akobo Minerals does not intend to register any portion of the offering of the securities in the United States or to conduct a public offering of the securities in the United States. Copies of this publication are not being, and may not be, distributed or sent into Australia, Canada, Japan or the United States.

Downloads: