Akobo Minerals AB: Agreement on debt restructuring, Private Placement successfully completed, announcement of rights issue and proposed conversion of unsecured debt

Published: 2024-02-27UTC16:30:00

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART DIRECTLY OR INDIRECTLY, IN AUSTRALIA, CANADA, JAPAN, HONG KONG OR THE UNITED STATES OR ANY OTHER JURISDICTION IN WHICH THE RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL. THIS ANNOUNCEMENT DOES NOT CONSTITUTE AN OFFER OF ANY OF THE SECURITIES DESCRIBED HEREIN

Oslo, 27 February 2024: Akobo Minerals AB ("Akobo" or the "Company"), a Scandinavian-based gold exploration and mining company with operations in Ethiopia, has today finalized an agreement regarding completion of debt restructuring (the "Debt Restructuring"). Additionally, the Company has successfully completed a private placement (the "Private Placement") of new shares (the “Offer Shares”) raising approximately NOK 34 million in gross proceeds. Furthermore, the Company’s board of directors has today resolved to proceed with a subsequent rights issue of new shares to raise gross proceeds of up to approximately EUR 2.5 million (the "Subsequent Rights Issue") and intends to propose a set-off issue of up to NOK 85,587,398 in relation to the conversion of two convertible loans and a bridge loan (the "Set-Off Issue"). The Debt Restructuring, the Private Placement, the Subsequent Rights Issue and the Set-Off Issue are jointly referred to as the "Transaction".

For a general company update and more information about the Transaction, please refer to the company presentation attached hereto, which is also published on Akobo's website (https://akobominerals.com/investors).

Jørgen Evjen, CEO of Akobo Minerals, says:

"I am pleased to announce that Akobo Minerals has successfully reached an agreement on debt restructuring with Monetary Metals, providing our company with enhanced flexibility and a longer maturity period. Additionally, we have concluded a successful Private Placement with our existing shareholders. I extend my sincere appreciation to all participants for their support, and I am genuinely grateful for their contribution towards moving Akobo Minerals into the next phase of gold production and continued exploration."

Debt Restructuring

Akobo is pleased to announce that it has finalized negotiations and amendments to the secured debt in the Company with its lender Monetary Metals Bond II LLC ("Monetary Metals"). The restructuring provides the Company with improved short- and medium-term liquidity and increases the overall robustness during the development stage/ramp-up phase of the Segele Mine. The amendments include but are not limited to: (i) a waiver of cash interest payments with accrual of PIK interest, (ii) increase in liquidity buffer by around USD 1.5 million before full production ramp-up and (iii) extension of the maturity date by one full year to December 2025. Completion of the Debt Restructuring is subject to (i) Akobo raising a minimum of NOK 40 million in gross cash proceeds, which through the previously announced NOK 6 million bridge loan and completion of the Private Placement will be fulfilled, and (ii) that warrants issued to Monetary Metals equating to 2% of Akobo's equity will be reset with a strike price equal to the Offer Price in the Private Placement being NOK 1.00. Please refer to the attached company presentation for additional details.

Private Placement

Akobo is pleased to announce that it has completed a private placement of a total of 34,003,550 Offer Shares, corresponding to approximately 64 % of the outstanding shares in the Company, at an offer price of NOK 1.00 per Offer Share (the "Offer Price"), raising gross proceeds of approximately NOK 34 million. The Private Placement was resolved by the board of directors of the Company (the “Board”) pursuant to an authorization to issue new shares granted by the extraordinary general meeting of the Company on 2 February 2024. Notification of allotment of the Offer Shares, including settlement instructions, will be sent to the applicants through a notification from the Manager on or about 28 February 2024.

The net proceeds from the Private Placement will be used to finance the construction phase of the Segele plant and subsequent production ramp up phase, to reach steady production and positive cash flow, as well as for general corporate purposes.

Following completion of the Private Placement, the Company's share capital will be SEK 3,238,628.30243317 divided into 87,153,773 shares, each with a par value of SEK 0.0371599322777818.

Settlement of the Offer Shares is expected to take place on or about 11 March 2024 on a delivery versus payment basis by delivery of new shares in the Company, expected to be facilitated by a quota value share issue agreement between the Company and the Manager (the "Quota Value Share Issue Agreement"). The Offer Shares allocated to applicants will not be tradable until the share capital increase pertaining to the Private Placement has been registered with the Swedish Companies Registration Office which subject to case handling time is expected on or about 11 March 2024.

The Private Placement represents a deviation from the existing shareholders' pre-emptive right to subscribe for the offer shares. The Board has carefully considered the Private Placement in light of the equal treatment obligations under the Swedish Companies Act, and the prohibition against giving anyone an unreasonable advantage at the Company's or the shareholders' expense set out in the Norwegian Securities Trading Act, Euronext Growth Oslo, Rule Book Part II section 3.1(2), and the Oslo Stock Exchange's Guidelines on the rules of equal treatment, and deems that the proposed Private Placement is in compliance with these obligations. The Board is of the view that it will be in the best interest of the Company and its shareholders to deviate from the shareholders' pre-emptive right as resolved through the Private Placement. The reason for the deviation from the shareholders’ pre-emption rights is that the Company is in immediate need of capital. In addition, the Debt Refinancing was conditional upon the Company raising at least NOK 40 million in new equity, and the Private Placement enabled the Company to carry out an equity raise in an efficient manner and in close coordination with the Debt Restructuring. By structuring the equity raise as a direct share issue, the Company was able to raise the equity capital, which the Debt Restructuring was conditioned upon, in an efficient manner and with lower completion risk compared, inter alia, to a rights issue. The Company's Board has investigated the conditions and carefully considered the possibility of only carrying out a rights issue in order to raise the required capital but has come to the conclusion that, for the aforementioned reasons, it was necessary to first carry out the Private Placement before the Subsequent Rights Issue could be pursued. The Subsequent Rights Issue may also partly mitigate the dilutive effects of the Private Placement on the Company’s existing shareholders who did not participate in the Private Placement as the investors in the Private Placement will not receive rights in the Subsequent Rights Issue based on their subscription in the Private Placement.

Subsequent Rights Issue

The Board has today resolved to proceed with and announce the Subsequent Rights Issue of up to 28,346,785 new shares in the Company. In aggregate, 53,150,223 subscription rights will be issued (the "Subscription Rights"). The Subsequent Rights Issue will, subject to applicable securities laws, be directed towards existing shareholders in the Company as of the end of trading on 5 March 2024 (as registered in the Norwegian Central Securities Depository (the "VPS") two trading days thereafter, on 7 March 2024) (the "Record Date”) and who are not resident in a jurisdiction where such offering would be unlawful or, for jurisdictions other than Norway, would require any prospectus, filing, registration or similar actions (the “Eligible Shareholders”). Eligible Shareholders will receive one (1) tradable subscription right for each share held in the Company as of the Record Date. Fifteen (15) Subscription Rights give the right to subscribe for eight (8) new shares. Subscription without Subscription Rights will be permitted in the Subsequent Rights Issue, however there is no guarantee that new shares will be allocated for such subscriptions. The subscription price per new share in the Subsequent Rights Issue will be the same as in the Private Placement (i.e. NOK 1.00 per share), which means that Akobo Minerals will receive gross proceeds of approximately EUR 2.5 million before deduction of transaction costs, provided that the Subsequent Rights Issue is fully subscribed.

Provided that the Subsequent Rights Issue is fully subscribed, the number of shares in Akobo Minerals will, through the Subsequent Rights Issue, increase by 28,346,785 from 87,153,773 to 115,500,558 and the share capital will increase by a maximum of approximately SEK 1,053,364.61089284, from SEK 3,238,628.30243317 to approximately SEK 4,291,992.91332601.

Indicative timetable of the Subsequent Rights Issue will be presented in a separate stock exchange announcement and the complete terms and conditions of the Subsequent Rights Issue will be presented in a national prospectus (Nw: "Nasjonalt Prospekt") that is expected to be published on the Company's website on or about 13 March 2024.

Proposed conversion of debt by conversion of two convertible loans and a bridge loan

Further, the Board has resolved convene an extraordinary general meeting on 2 April 2024 (the “EGM”) to decide upon the Set-Off Issue to lenders of the bridge loan as announced in the Company’s stock exchange announcement made on 8 February 2024 and the holders of the two convertible loans announced by the Company on 20 March 2023 and 6 September 2023.

Lenders representing 83 % of the bridge loan have, as of today, committed to convert the outstanding amount thereunder (including accrued interests and interests which will accrue until maturity), and lenders representing 92 % of the total outstanding amount under the convertible loans have, as of today, committed to the same. The remaining lenders under the convertible loans and the bridge loan will be offered the opportunity to convert their respective portions of the convertible loans and the bridge loan.

Conversion of the bridge loan and the convertible loans into new shares in the Company will be the same price per share as in the Private Placement (i.e. NOK 1.00 per share).

Any conversion of the bridge loan and/or the convertible loans is subject to approval by the EGM of the Set-Off Issue.

Notice convening the EGM will be published separately today. Further information will be announced in a separate stock exchange announcement.

Advisors

SpareBank 1 Markets AS has acted as financial advisor to the Company and Advokatfirmaet Schjødt AS has acted as legal advisor to the Company in connection with the Transaction.

For more information, please contact:

Jørgen Evjen, CEO, Akobo Minerals

Mob: (+47) 92 80 40 14

Mail: jorgen@akobominerals.com

LinkedIn: www.linkedin.com/company/akobominerals

Web: www.akobominerals.com

This information is considered to include inside information pursuant to the EU Market Abuse Regulation (MAR) and is subject to the disclosure requirements pursuant to section 5-12 of the Norwegian Securities Trading Act. This announcement was published by Jørgen Evjen on 27 February 2024 at 17.30 CET.

About Akobo Minerals

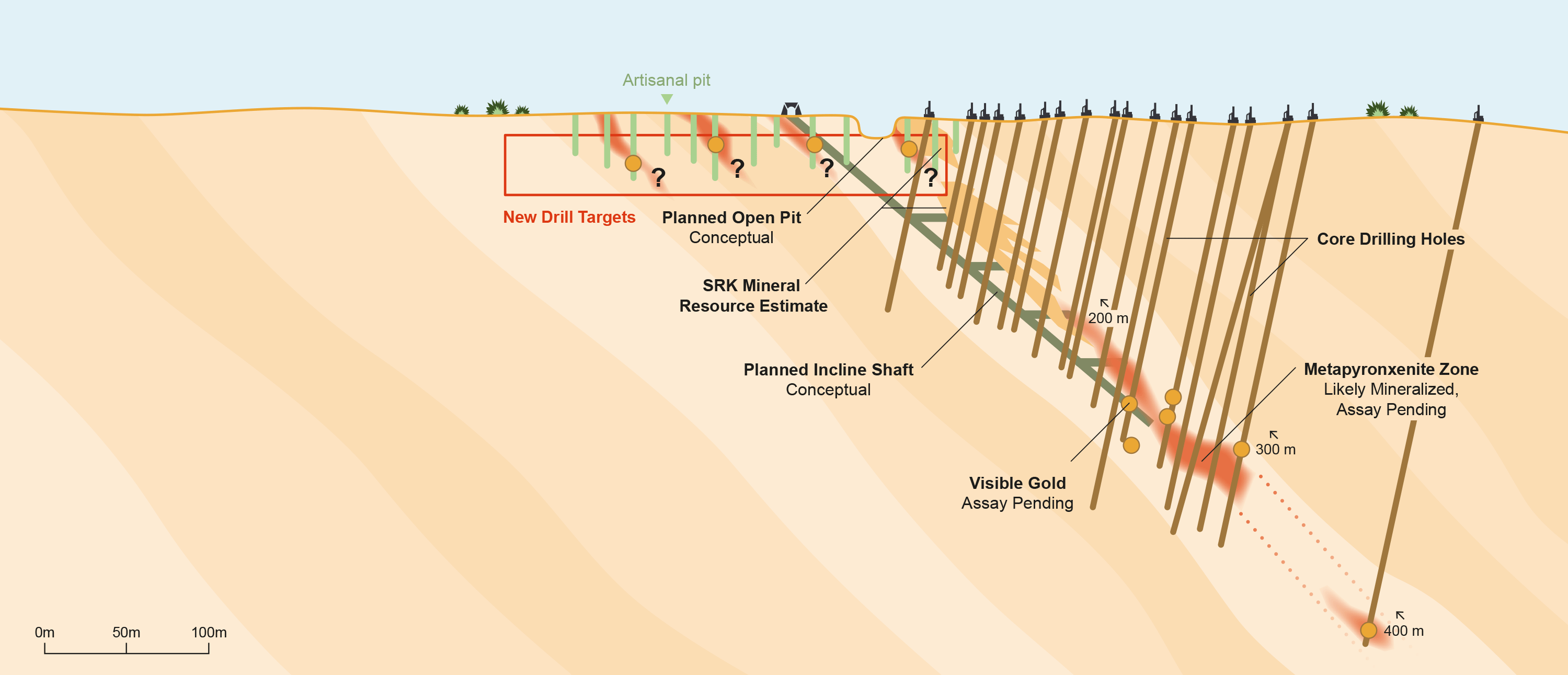

Akobo Minerals is a Scandinavian-based gold exploration and boutique mining company, currently holding an exploration license covering 182 km2 and a mining license covering 16 km2 in the Gambela region and Dima Woreda, Ethiopia. The company has established itself as the leading gold exploration company in Ethiopia through more than 13 years of on-the-ground activity, which has now been enhanced further with the development of its Segele mine.

Akobo Minerals’ Segele mine has an Inferred and Indicated Mineral Resource of 68,000 ounces, yielding a world-class gold grade of 22.7 g/ton. Still open to depth, the gold mineralised zone continues to expand and will have a positive impact on future resource estimates and the life expectancy of the mine. The exploration license holds numerous promising exploration resource-building prospects in both the vicinity of Segele and in the wider license area.

Akobo Minerals has an excellent relationship with local communities all the way up to national authorities and the company places environment and social governance (ESG) at the heart of its activities – as demonstrated by a planned, industry-leading, extended shared value program.

Akobo Minerals has built a strong local foothold based on the principles of sound ethics, transparency and communication, and is ready to take on new opportunities and ventures as they arise. The company is uniquely positioned to become a major player in the future development of the very promising Ethiopian mining industry. The company is headquartered in Oslo and is publicly listed on the Euronext Growth Oslo Exchange and the Frankfurt Stock Exchange under the ticker symbol AKOBO. For US investors, Akobo Minerals AB (OTCQX: AKOBF) is traded on the OTCQX Best Market, adhering to high financial standards, best practice corporate governance, and compliance with U.S. securities laws. Additionally, the company has a professional third-party sponsor introduction, and investors can access current financial disclosures and Real-Time Level 2 quotes for the company on www.otcmarkets.com.

Akobo Minerals places great emphasis on meeting and exceeding industry standards, fully complying with all aspects of the JORC code, 2012. For detailed information on their adherence to this code, please refer to https://www.jorc.org/. Akobo Minerals' unwavering commitment to ethical practices, community engagement, and environmental responsibility positions them as a formidable force in the evolving landscape of the Ethiopian mining sector.

Important information

This press release and the information herein is not for publication, release or distribution, in whole or in part, directly or indirectly, in or into Australia, Canada, Japan, Hong Kong or the United States or any other state or jurisdiction in which publication, release or distribution would be unlawful or where such action would require additional prospectuses, filings or other measures in addition to those required under Swedish or Norwegian law.

The press release is for informational purposes only and does not constitute an offer to sell or issue, or the solicitation of an offer to buy or acquire, or subscribe for, any of the securities mentioned herein (collectively, the "Securities") or any other financial instruments in Akobo Minerals AB. Offers will not be made to, and application forms will not be approved from, subscribers (including shareholders), or persons acting on behalf of subscribers, in any jurisdiction where applications for such subscription would contravene applicable laws or regulations, or would require additional prospectuses, filings, or other measures in addition to those required under Swedish or Norwegian law. Measures in violation of the restrictions may constitute a breach of relevant securities laws.

The Securities mentioned in this press release have not been registered and will not be registered under any applicable securities law in Australia, Canada, Japan, Hong Kong or the United States and may, with certain exceptions, not be offered or sold within, or on behalf of a person or for the benefit of a person who is registered in, these countries. The company has not made an offer to the public to subscribe for or acquire the Securities mentioned in this press release other than in Sweden and Norway.

None of the Securities have been or will be registered under the United States Securities Act of 1933, as amended (the "Securities Act"), or the securities laws of any state or other jurisdiction in the United States, and may not be offered, pledged, sold, delivered or otherwise transferred, directly or indirectly. There will not be any public offering of any of the Securities in the United States.

In the EEA Member States, with the exception of Sweden (each such EEA Member State, a "Relevant State"), this press release and the information contained herein are intended only for and directed to qualified investors as defined in the Prospectus Regulation. The Securities mentioned in this press release are not intended to be offered to the public in any Relevant State and are only available to qualified investors except in accordance with exceptions in the Prospectus Regulation. Persons in any Relevant State who are not qualified investors should not take any actions based on this press release, nor rely on it.

In the United Kingdom, this press release is directed only at, and communicated only to, persons who are qualified investors within the meaning of article 2(e) of the Prospectus Regulation (2017/1129) who are (i) persons who fall within the definition of "investment professional" in article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "Order"), or (ii) persons who fall within article 49(2)(a) to (d) of the Order, or (iii) persons who are existing members or creditors of Akobo Minerals AB or other persons falling within Article 43 of the Order, or (iv) persons to whom it may otherwise be lawfully communicated (all such persons referred to in (i), (ii), (iii) and (iv) above together being referred to as "Relevant Persons"). This press release must not be acted on or relied on by persons in the UK who are not Relevant Persons.

This announcement does not constitute an investment recommendation. The price and value of securities and any income from them can go down as well as up and you could lose your entire investment. Past performance is not a guide to future performance. Information in this announcement cannot be relied upon as a guide to future performance.

Forward-looking statements

This press release contains forward-looking statements that reflect the Company's intentions, assessments, or current expectations about and targets for the Company's future results of operations, financial condition, development, liquidity, performance, prospects, anticipated growth, strategies and opportunities and the markets in which the Company operates. Forward-looking statements are statements that are not historical facts and may be identified by the fact that they contain words such as "believe", "expect", "anticipate", "intend", "may", "plan", "estimate", "will", "should", "could", "aim" or "might", or, in each case, their negative, or similar expressions. The forward-looking statements in this press release are based upon various assumptions, many of which are based, in turn, upon further assumptions. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurances that they will materialize or prove to be correct. Because these statements are based on assumptions or estimates and are subject to risks and uncertainties, the actual results or outcome could differ materially from those set out in the forward-looking statements as a result of many factors. Such risks, uncertainties, contingencies and other important factors could cause actual events to differ materially from the expectations expressed or implied in this release by such forward-looking statements. The Company does not guarantee that the assumptions underlying the forward-looking statements in this press release are free from errors nor does it accept any responsibility for the future accuracy of the opinions expressed in this press release or any obligation to update or revise the statements in this press release to reflect subsequent events. Readers of this press release should not place undue reliance on the forward-looking statements in this press release. The information, opinions and forward-looking statements contained in this press release speak only as at its date and are subject to change without notice. Neither the Company nor anyone else does undertake any obligation to review, update, confirm or to release publicly any revisions to any forward-looking statements to reflect events that occur or circumstances that arise in relation to the content of this press release.

Information to distributors

Solely for the purposes of the product governance requirements contained within: (a) EU Directive 2014/65/EU on markets in financial instruments, as amended ("MiFID II"); (b) Articles 9 and 10 of Commission Delegated Directive (EU) 2017/593 supplementing MiFID II; and (c) local implementing measures (together, the "MiFID II Product Governance Requirements"), and disclaiming all and any liability, whether arising in tort, contract or otherwise, which any "manufacturer" (for the purposes of the MiFID II Product Governance Requirements) may otherwise have with respect thereto, the shares in Akobo Minerals have been subject to a product approval process, which has determined that such shares are: (i) compatible with an end target market of retail investors and investors who meet the criteria of professional clients and eligible counterparties, each as defined in MiFID II; and (ii) eligible for distribution through all distribution channels as are permitted by MiFID II (the "Target Market Assessment"). Notwithstanding the Target Market Assessment, Distributors should note that: the price of the shares in Akobo Minerals may decline and investors could lose all or part of their investment; the shares in Akobo Minerals offer no guaranteed income and no capital protection; and an investment in the shares in Akobo Minerals is compatible only with investors who do not need a guaranteed income or capital protection, who (either alone or in conjunction with an appropriate financial or other adviser) are capable of evaluating the merits and risks of such an investment and who have sufficient resources to be able to bear any losses that may result therefrom. The Target Market Assessment is without prejudice to the requirements of any contractual, legal or regulatory selling restrictions in relation to the Directed Share Issue.

For the avoidance of doubt, the Target Market Assessment does not constitute: (a) an assessment of suitability or appropriateness for the purposes of MiFID II; or (b) a recommendation to any investor or group of investors to invest in, or purchase, or take any other action whatsoever with respect to the shares in Akobo Minerals.

Each distributor is responsible for undertaking its own target market assessment in respect of the shares in Akobo Minerals and determining appropriate distribution channels.