“Our maiden resource estimate done by SRK Consulting indicates 52 000 oz at 20.9 g/t on average, which is fairly astonishing."

—

Jump forward to today and the company is confident of pouring first gold from its flagship project Segele in Q4, 2022. GERARD PETER reports.

Evjen explains that Akobo is currently the only gold company listed on the Euronext exchange in Oslo. This is due to the fact that previously listed mining companies such as Crew Minerals, Northland Resources, Wega Mining and Avocet Mining, have had limited or no success with their efforts.

“Previously, the results were catastrophic when companies tried to move from exploration into mining. As such, there is a mindset that we won’t be successful. However, we are determined to do things differently by being transparent, ensuring we adhere to regulations and communicating effectively with our shareholders.”

The company is a rather small operation with three managers – Evjen, COO Matt Jackson and Chief Exploration Manager Johan Sjöberg– first 2 located in Norway last one in Sweden.

“All our activities on the ground however are undertaken by Ethiopians, which currently number around 40 staff,” Evjen adds.

The company is primarily funded by family and friends with the majority living in Trondheim, a small town in the middle part of Norway.

Akobo is focusing on two projects – Segele and Joru – along the Akobo River in south-western Ethiopia, a prolific area with extensive alluvial gold production.

Though both are considered exciting prospects for gold, each is different. Segele is quite small, with a high concentration of gold, while Joru covers a larger area, with a lower gold content.

After Segele and Joru, there are many exciting prospects which so far have not been investigated due to limited capacity.

Evjen explains that up until October 2021, the company was focussed purely on exploration with no intention of become a gold producer. However, this has subsequently changed following promising results from Segele, which the company is now fast tracking to production stage.

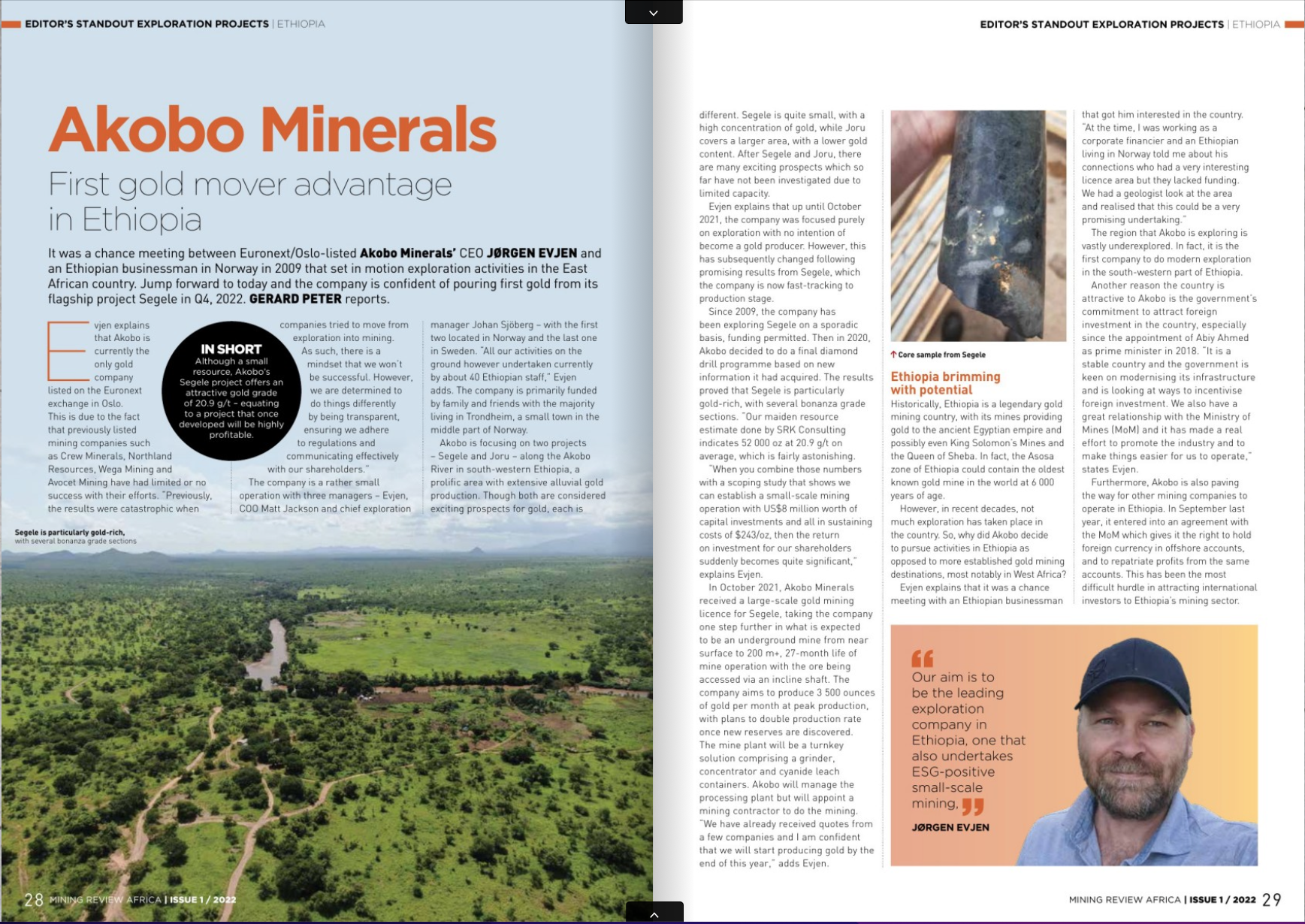

Since 2009, the company has been exploring Segele on a sporadic basis, funding permitted. Then in 2020, Akobo decided to do a final diamond drill programme based on new information it had acquired. The results proved that Segele is particularly gold-rich, with several bonanza grade sections.

“Our maiden resource estimate done by SRK Consulting indicates 52 000 oz at 20.9 g/t on average, which is fairly astonishing.

“When you combine those numbers with a scoping study that shows we can establish a small-scale mining operation with US$8 million worth of capital investments and all in sustaining costs of $243/oz, then the return on investment for our shareholders suddenly became quite significant,” explains Evjen.

In October 2021, Akobo Minerals received a large-scale gold mining license for Segele taking the company one step further in what is expected to be an underground mine from near surface to 200 m+, 27 month life of mine operation with the ore being accessed via an incline shaft. The company aims to produce 3 500 ounces of gold per month at peak production, with plans to double production rate once new reserves are discovered.

The mine plant will be a turnkey solution comprising a grinder, concentrator and cyanide leach containers. Akobo will manage the processing plant but will appoint a mining contractor to do the mining. “We have already received quotes from a few companies and I am confident that we will start producing gold by the end of this year,” adds Evjen.

Historically, Ethiopia is a legendary gold mining country, with its mines providing gold to the ancient Egyptian empire and possibly even King Solomon’s Mines and the Queen of Sheba. In fact, the Asosa zone of Ethiopia could contain the oldest known gold mine in the world at 6 000 years of age.

However, in recent decades, not much exploration has taken place in the country. So, why did Akobo decide to pursue activities in Ethiopia as opposed to in more established gold mining destinations, most notably in West Africa?

Evjen explains that it was a chance meeting with an Ethiopian businessman that got him interested in the country. “At the time, I was working as a corporate financer and an Ethiopian living in Norway told me about his connections who had a very interesting licence area but they lacked funding. We had a geologist look at the area and realised that this could be a very promising undertaking.”

The region that Akobo is exploring is vastly under-explored. In fact, it is the first company to do modern exploration in the south-western part of Ethiopia.

Another reason the country is attractive to Akobo is the government’s commitment to attract foreign investment in the country, especially since the appointment of Abiy Ahmed as prime minister in 2018.

“It is a stable country and the government is keen on modernising its infrastructure and is looking at ways to incentivise foreign investment. We also have a great relationship with the Ministry of Mines (MoM) and it has made a real effort to promote the industry and to make things easier for us to operate,” states Evjen.

Furthermore, Akobo is also paving the way for other mining companies to operate in Ethiopia. In September last year, it entered into an agreement with the MoM which gives it the right to hold foreign currency in offshore accounts, and to repatriate profits from the same accounts. This has been the most difficult hurdle in attracting international investors to Ethiopia’s mining sector.

However, it is not just about operating a profitable mine in the country. Akobo is keen to do so in a transparent and ethical way, one which benefits the company, communities and the country. To that end, it employed leading ESG expert, Dr CATHRYN MACCALLUM of Sazani Associates to draw up its ESG policy.

“We looked at things differently. For example, instead of building roads or schools, we want to empower communities to do these things on their own. We have also drawn up a Sustainable National Resource Management Plan where we develop sustainable livelihoods for communities to replant trees, clean up rivers and promote agricultural activities,” adds Evjen.

The company is working to put a carbon credit system in place. “For example, by planting more trees, it will increase the biomass of the region and will generate carbon credits. The money earned will be made available on a local level to further develop communities,” explains Evjen.

The company believes it is a first-mover in a new era of developing alternative livelihoods for its partners in the community.

Looking ahead, Evjen states the development of Segele will allow the company to fund further exploration activities in the country over the next 10 to 15 years. “Our aim is to be the leading exploration company in Ethiopia, one that also undertakes ESG-positive small-scale mining. And this is the goal not only in the region we are currently exploring but in other parts of the country as well,” he concludes.

For more information please caontact,

Jørgen Evjen

CEO Akobo Minerals AB and Etno Mining P.l.c

Mob NO: +47 92 80 40 14

Mob ET: +251 944 76 2428

email: jorgen@akobominerals.com

—

Akobo Minerals, is a Norway-based gold exploration company, currently with ongoing exploration and small-scale mine development in the Gambela region and Dima Woreda, southwest Ethiopia. The operations were established in 2009 by people with long experience from the public mining sector in Ethiopia and from the Norwegian oil service industry. Akobo Minerals holds a mining licence and an exploration license over key targets in the area. Economic mineralisation was discovered and the company is engaged in mining studies to advance the project to production, alongside exploration core drilling. Akobo Minerals is transforming its organisation to support an increased pace of core drilling. At both the key targets Segele and Joru the company has so far released exceptionally high-grade gold results including the Segele deposit with an Inferred Mineral Resource of 78ktons at 20.9g/t. A scoping study for Segele includes an up-front capital expenditure of USD $8m and all-in sustaining cost of USD $243 per ounce of gold produced. Core-drilling and trenching at Joru have intersected both high-grade gold zones and large wide zones near surface. The company has an excellent partnership with national authorities and places ESG at the heart of its activities – a ground-breaking community program is being planned.

Akobo in Mining Review Africa